For nearly six decades, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been running circles around Wall Street's flagship index, the S&P 500. Since taking the reins as CEO, the aptly dubbed "Oracle of Omaha" has overseen an aggregate return in his company's Class A shares of 4,927,141%, as of the closing bell on March 8, 2024. That compares to a total return, including dividends paid, of around 33,500% for the S&P 500 over the same period.

Riding Warren Buffett's coattails has been a moneymaking strategy for decades, which is made all the easier thanks to Form 13F filings with the Securities and Exchange Commission. A 13F provides a snapshot of what Wall Street's smartest and most successful investors are buying and selling, and is a required quarterly filing for money managers overseeing at least $100 million in assets under management.

Although most investors are intrigued to see what the Oracle of Omaha and his investment aides, Ted Weschler and Todd Combs, have been buying, understanding why Buffett and his team are selling certain stocks can be just as insightful.

Based on Berkshire's most recent 13F, Warren Buffett and his team are selling seven stocks.

1. Paramount Global: 30,408,484 shares sold (63,322,491 shares remaining)

The first sizable holding that found itself on the chopping block during the December-ended quarter is media company Paramount Global (NASDAQ: PARA). Buffett's company pared down nearly a third of its position, which had stood at north of 93 million shares.

The catalyst for dumping more than 30 million shares looks to be Paramount's undesirable balance sheet. More specifically, the company is lugging around $14.6 billion in long-term debt, compared to just $2.46 billion in cash and cash equivalents, as of the end of 2023. With cord-cutting ongoing and Paramount's streaming segment still losing money, investors (including Buffett) have begun to lose patience.

The other side of the coin is that Paramount's streaming segment losses are lessening thanks to higher subscription prices being passed along to users. Further, legacy media companies tend to enjoy a resurgence in ad spending during major election years. Although Paramount Global clearly has concerns to address, things may not be as dire as its poor stock performance would suggest.

2. HP: 79,666,320 shares sold (22,852,715 shares remaining)

Another high-profile name that took a big haircut in Berkshire Hathaway's investment portfolio during the fourth quarter is personal computing and printing services provider HP (NYSE: HPQ). Buffett and his aides dumped close to 78% of Berkshire's stake, compared to what was held on Sept. 30, 2023.

The impetus behind this selling activity may have to do with the sluggishness of personal computer (PC) sales. Though PC sales surged during the initial stages of the COVID-19 pandemic, they've meaningfully retraced with most employees returning to the office. With no sales growth forecast for the current year, HP's 3.6% dividend yield simply isn't enough of a lure to keep Buffett and his team interested.

HP also looks like a perfect example of a "fair company at a wonderful price" that Buffett would prefer to avoid. Although HP stock can be purchased for a mere 8 times forward year earnings, the company's growth days are long gone. Now reliant on relatively low-margin products and printing services, HP lacks the needle-moving results Berkshire's brightest minds desire.

3. Apple: 10,000,382 shares sold (905,560,000 shares remaining)

Perhaps the most surprising selling activity during the fourth quarter was the roughly 10 million shares Buffett and his investing "lieutenants" parted ways with in tech stock Apple (NASDAQ: AAPL). Keep in mind that selling 10 million shares only reduced Berkshire's stake in its top holding by 1.1%.

Chances are the Oracle of Omaha hasn't changed his tune on what he previously referred to as "a better business than any we own." Apple's physical product innovation has led the way for more than a decade, with the company now also emphasizing high-margin subscription services. To boot, Apple has repurchased $650.9 billion of its own common stock since the start of 2013, which is tops among public companies.

The most logical reason Buffett and his investing crew pared down their Apple stake is to offset realized investment losses from Paramount Global and HP. Buffett's company is sitting on an estimated $119 billion in unrealized gains on its Apple stock.

4. Markel Group: 158,715 shares sold (entire position sold)

A popular holding that was given the heave-ho from Berkshire's investment portfolio during the December-ended quarter is insurance and investment company Markel Group (NYSE: MKL), which has been dubbed something of a "mini-Berkshire" given its penchant for making investments. Buffett and his team dumped their entire position in Markel, which had been a continuous holding since the first quarter of 2022.

There are two educated guesses as to why Markel found itself on the chopping block. The likeliest answer is valuation. Since 2015, Markel Group had traded at or below 120% of its book value on only a handful of occasions. One of those instances was during the first quarter of 2022. With Markel's premium-to-book value nearing 50% just prior to the start of October 2023, the luster of getting a "deal" may have worn off.

The other possibility is Weschler or Combs, not Buffett, cut Markel loose. Buffett's investment aides are considerably more active on the trading front than he is, and this position was ultimately held less than two years.

5. StoneCo: 10,695,448 shares sold (entire position sold)

Brazil-focused fintech company StoneCo (NASDAQ: STNE), which had been a five-year holding in Berkshire's portfolio, was also shown the door during the fourth quarter.

The motivation for Buffett and his team to part ways with StoneCo probably had to do with the company's debt-driven challenges. Brazil's central bank raised interest rates to as high as 13.75% in 2022 to get the country's inflation rate under control. Unfortunately, StoneCo's loan division was backed by debt, which sent its servicing costs soaring. Even though management has addressed these issues, StoneCo is still something of a work in progress.

On the other hand, StoneCo has its fingers in far more than just payments in Brazil's economy. It offers banking and credit solutions, as well as software, to micro, small, and medium-sized businesses. Although add-on service adoption is climbing, StoneCo has penetrated just a small fraction of the fintech market in Brazil.

6. Globe Life 831,014 shares sold (entire position sold)

The sixth stock Buffett and his team kicked to the curb during the December-ended quarter was longtime holding Globe Life (NYSE: GL). Prior to its departure, life and supplemental health insurance company Globe Life had been a continuous holding in Berkshire Hathaway's investment portfolio for more than two decades.

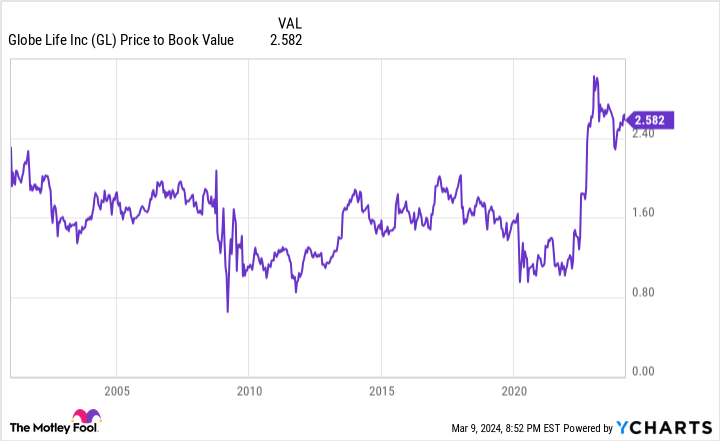

Valuation looks to be the most sensible reason behind Buffett & Co.'s decision to sell. Shares of the company more than doubled following the March 2020 COVID-19 crash, sending its price-to-book value to nearly 300% during the fourth quarter. At no point during the 22 years that Berkshire held shares of Globe Life did it sustain a book value of more than 200% for any length of time, let alone near 300%.

Buffett and his team are also known for concentrating Berkshire's investments in their top ideas. Globe Life never met the definition of a core holding, which ultimately sealed its fate.

7. D.R. Horton: 5,969,714 shares sold (entire position sold)

Last but not least, the Oracle of Omaha and his team booted homebuilder D.R. Horton (NYSE: DHI) from Berkshire's investment portfolio during the December-ended quarter.

This is one of the biggest head-scratchers of all considering shares of D.R. Horton were only acquired during the June-ended quarter. Since Warren Buffett is a firm believer in holding wonderful businesses for extended periods, the purchase and subsequent sale of D.R. Horton suggests that Ted Weschler and/or Todd Combs were the masterminds behind this relatively quick trade.

History may also have played a role in dumping shares of D.R. Horton. Homebuilders aren't known for delivering outsized investment returns. Depending on Berkshire's entry and exit, it could have been up north of 50% on its stake in D.R. Horton in under nine months. That's an incredible gain for a traditionally slow-moving, highly cyclical industry. With various money-based metrics and predictive indicators alluding to a possible recession in 2024, locking in gains may have been prudent.

Should you invest $1,000 in Paramount Global right now?

Before you buy stock in Paramount Global, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the10 best stocks for investors to buy now… and Paramount Global wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service hasmore than tripledthe return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, HP, Markel Group, and StoneCo. The Motley Fool has a disclosure policy.

Here Are All 7 Stocks Warren Buffett Is Selling was originally published by The Motley Fool